“The Lord detests dishonest scales, but accurate weights find favor with him.” – Proverbs 11:1

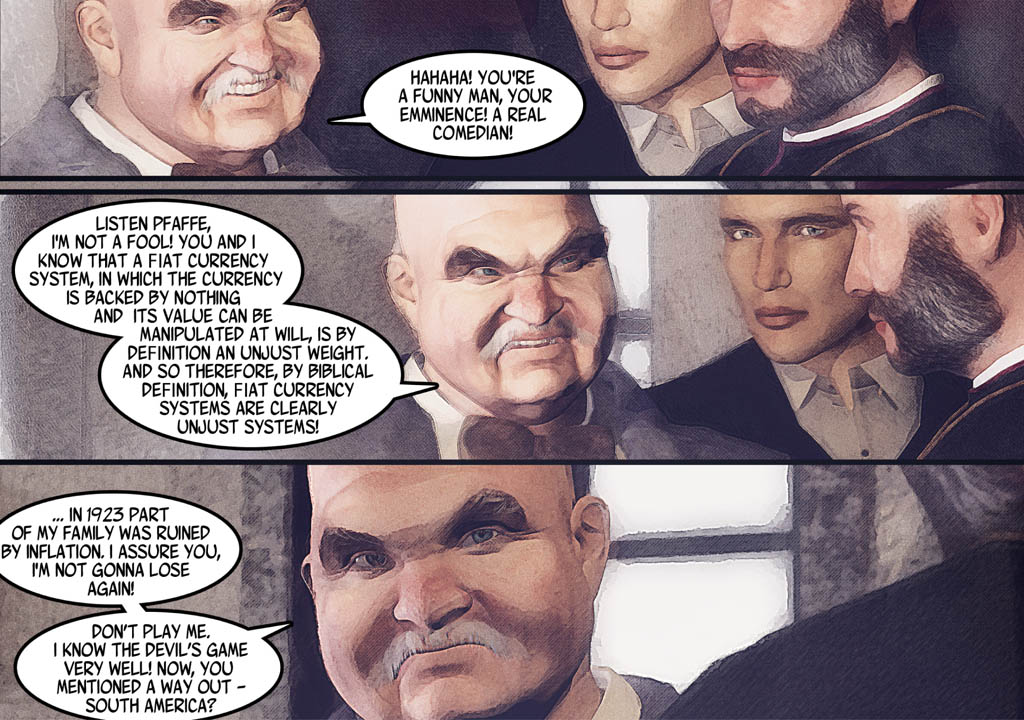

Oskar Gross, the sharp-minded industrialist from Maier Files, saw the corruption of the fiat money system long before others realized the full extent of its destruction. His fierce opposition to central banking and bankers manipulating currencies stemmed from an undeniable truth—fractional reserve banking is fraudulent and ruinous.

But what exactly is this scam that governs our global financial system?

The Illusion of Wealth – What Is Fractional Reserve Banking?

Fractional reserve banking is the system where banks are allowed to lend out more money than they actually possess. A small percentage of actual cash deposits is kept as “reserves,” while the rest is loaned out—creating money out of nothing. This fraudulent practice enables banks to expand the money supply exponentially without backing it with real assets. The consequences?

- Economic instability – Repeated booms and busts.

- Debt slavery – The constant need to borrow more just to survive.

- Wealth theft – Silent inflation that erodes purchasing power.

As the economist Manuel Tacanho states in his scholarly paper:

“Fractional reserve banking is further fraudulent because it enables a few members of society (i.e., banking institutions) to create money out of nothing by lending it into existence.”

This means banks literally create purchasing power out of thin air, while you must trade your labor, time, and energy to obtain money.

A System Built on Fraud – The Bankers’ Power Grab

Historically, money was tied to gold and silver, ensuring a fair exchange of value. But over time, bankers devised schemes to control money creation, detaching it from real assets. The central banking system was established, allowing governments and financial elites to print endless fiat money, devaluing currency while enriching themselves.

Tacanho further exposes this in his paper:

“Fractional reserve banking undermines trust in the banking system and breeds financial instability, leading to more frequent crises, bank runs, and other adverse economic and societal consequences.”

Fiat Money: The Ultimate Dishonest Scale

Oskar Gross condemned fiat money as a dishonest scale, an artificial measurement manipulated at will by those in power. In Maier Files, his distrust of globalist bankers mirrors real-world concerns—how can a society function when its entire monetary system is a fraudulent scheme?

The Bible warns against such deceit:

“The Lord detests dishonest scales, but accurate weights find favor with him.” – Proverbs 11:1

Fiat money is the ultimate dishonest scale:

❌ It is not backed by real assets.

❌ It devalues over time, stealing from savers.

❌ It enriches banks at the expense of workers.

The Federal Reserve, European Central Bank, and IMF—all operate under this corrupt model, ensuring nations remain in perpetual debt servitude.

The Lockridge Device – A Forgotten Alternative to Bank Tyranny?

In contrast to this corrupt financial system, history hints at alternative energy and financial solutions that were buried or ignored. One such example is the Lockridge Device—an alleged German energy device smuggled into the United States by an American soldier after World War II.

Could it have provided energy independence, freeing nations from reliance on bank-controlled resources? Was it suppressed because it threatened the globalist financial elite?

We will explore this intriguing case in our next article, revealing another layer of hidden history the bankers don’t want you to know.

Final Thoughts – A Rigged System

Fractional reserve banking is nothing more than an illusion—a system of manufactured debt and artificial wealth controlled by a select few.

💡 The truth is simple:

1. Banks create money out of nothing, while you must work for it.

Imagine you walked into a grocery store, took food off the shelves, and paid with fake money you just printed at home. You would be arrested for counterfeiting.

Yet banks do exactly this—except legally. When you take out a loan, the bank doesn’t lend you money it already has. Instead, it creates new money out of nothing, entering digits into a computer. That money never existed before—but your debt is real. You must work, sweat, and struggle to repay it—plus interest.

Who benefits? The banks.

Who loses? You.

And the cycle repeats endlessly—because under fractional reserve banking, new money is always created as debt. This means that debt can never truly be repaid without causing financial collapse. The system requires permanent borrowing just to keep running. This is why nations, corporations, and individuals are trapped in an endless cycle of borrowing, repaying, borrowing again. The banks always win.

2. Inflation is a hidden tax, eroding your purchasing power without you noticing.

Most people believe inflation means “things just get more expensive”—but this is a lie. The truth is that inflation is the government and central banks stealing from you without you realizing it.

Here’s how it works:

🔹 Every time a central bank prints new money, the total money supply increases.

🔹 But goods and services don’t magically increase at the same rate.

🔹 This means more money is chasing the same amount of goods—so prices rise.

But here’s the key:

Your wages don’t increase at the same pace.

Example:

Let’s say you had $10,000 in savings in 2010. That money could buy a certain amount of food, gas, rent, etc. Now, in 2024, due to inflation, your $10,000 buys far less—even though you didn’t spend a dime of it.

Your money lost value because the government and banks created new money, diluting the purchasing power of every dollar you own. It’s a tax—a way to take your wealth without you ever seeing a tax bill.

This is why politicians and economists never explain inflation properly. They just say “prices are going up”, as if it’s a natural phenomenon—when in reality, it’s engineered theft.

🔹 Who benefits? Governments (who pay off debts with devalued money) and banks.

🔹 Who loses? You—your savings, your salary, your future.

This is why the wealthy invest in assets (real estate, gold, stocks) while the middle class and poor hold cash—and get robbed by inflation.

3. Every financial crisis benefits the banks while crushing the people.

Think back to the 2008 financial crisis. The world was plunged into recession, millions of people lost jobs, homes, and savings. But who got bailed out?

The banks that caused the crisis.

The U.S. government printed trillions of dollars to rescue Wall Street, while Main Street suffered. Banks that should have collapsed were saved, and the cost was passed on to taxpayers and future generations.

This cycle happens again and again:

- 2008: Mortgage crisis—banks bailed out.

- 2020: COVID economic collapse—banks and corporations got trillions in stimulus.

- 2023: Bank failures (Silicon Valley Bank, First Republic)—government steps in again.

Each time, regular people pay the price—higher taxes, inflation, lost savings—while banks and elites walk away richer than before.

It’s a rigged game. The financial system is not designed to help you—it is designed to extract wealth from you.

A System Designed to Keep You in Debt

Oskar Gross saw it for what it was: a system of dishonest scales, a money trap designed to keep nations and individuals under the thumb of globalist bankers.

The only way out is to expose the scam—and find alternatives that restore financial independence and real wealth.

🔎 Next article: The Lockridge Device – Lost Energy Secrets from WWII?

src.: Tacanho Manuel, The Fraudulent and Ruinous Nature of Fiat Monetary Systems (August 20, 2024).

Available at SSRN: https://ssrn.com/abstract=4931816 or http://dx.doi.org/10.2139/ssrn.4931816